Chile is a

small economy, for which international economic insertion has been the growth

strategy in recent decades. As part of economic globalization, this opening has

contributed to overcoming distance limits, reducing transportation costs, and

expanding the internationalization of its companies. This commercial policy of

Chile, given its small domestic market, has implied a greater use of

international markets to expand the exportable offer of the country's

companies, creating a growth model based on exports of goods, services and

direct foreign investment.

Consistent with this country strategy, in 2018 Chile maintained 26 trade agreements with 64 markets, which represent 63% of the world population and 86.3% of global GDP. Under this policy, the Chilean presence in world markets has been felt strongly in sectors such as Mining, Fishing, Viticulture, Wood, Cellulose and Paper, Fruit, Agroindustry and some Services.

At the same time, this open economy policy since its inception in the 1970s allowed imported footwear and leather goods to enter easily the country without restrictions, customs duties free, only by paying a general VAT rate of 19% on the CIF value, which the importer recovers as a tax credit. The only cost of admission corresponds to the tariffs for services of the Customs Agent involved in each import operation.

Since

the Free Trade Agreement with China entered into force in 2010, footwear of

that origin enters Chile without barriers and with zero tax rate.

The

large Chilean footwear industries disappeared and were partially replaced by

smaller companies. In tune, many supplier industries also stopped working.

A

large part of Chilean factories chose to maintain their commercial structures

and produce footwear in Asia, Africa and in some Latin American countries.

The alternative is presented with the appearance of micro and small workshops

specialized in market niches: as well as entrepreneurs dedicated to the design

and production of Author's footwear. In this case, many

have their own points of sale and a loyal clientele. Their

competitiveness is based on the flexibility of small productions, which allow

them to quickly deliver fashion products.

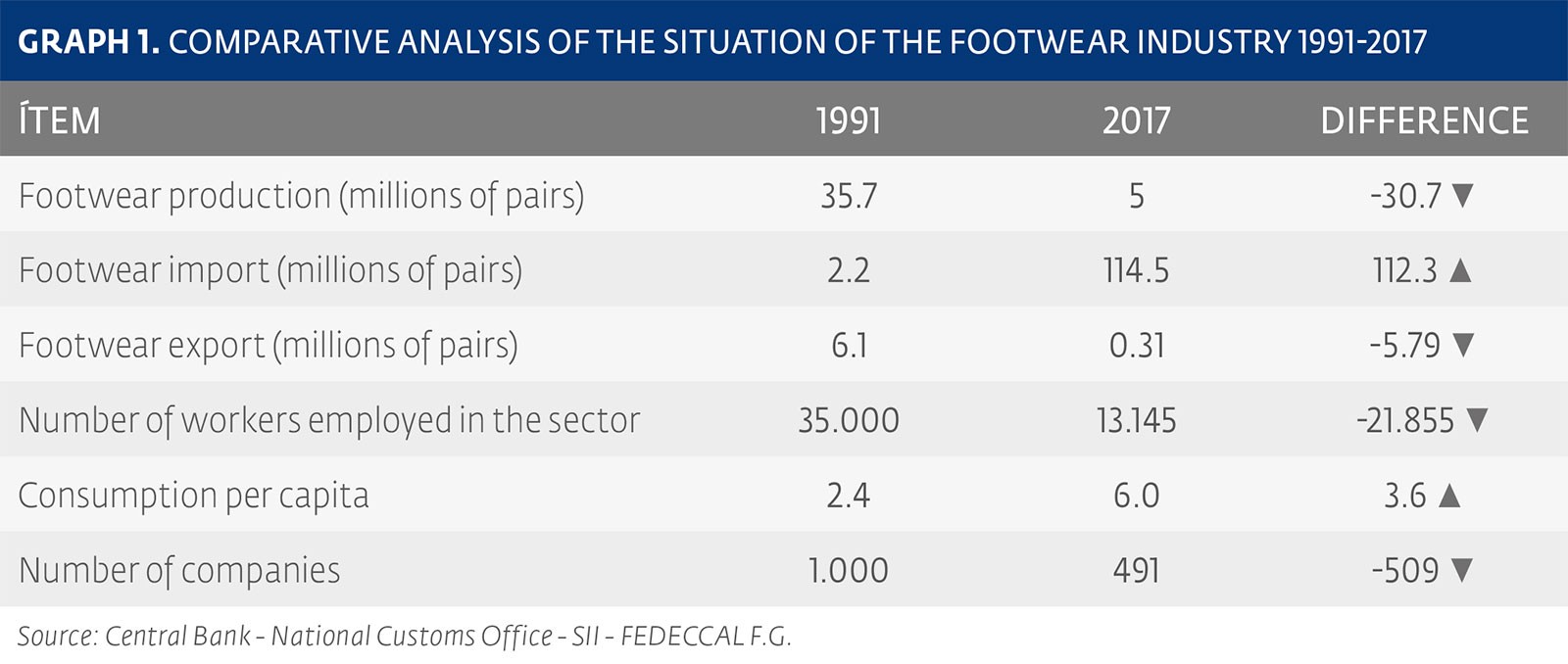

GRAPH 1 compares the main variables between 1991 and 2017.

With

a total population of 18.3 million inhabitants, the annual consumption of

footwear per capita in Chile, in 2017, reached 6.0 pairs of footwear per

person. Over the total of 10.9 million pairs consumed, 90% is of imported

origin. Currently, Chile has an annual per capita income of US $ 15,071.

Based on

data from the consumer survey conducted by FEDECCAL -Leather and Footwear

Federation of Chile- in 2015, the following guidelines can be extracted:

· To buy shoes, the preferred places are traditional stores, such as multi-stores, specialty stores, own brands, etc.

· Internet purchases are still not relevant.

· Women spend more on footwear than men.

· The main attributes to buy are: quality, comfort, design and price.

· Estimate of footwear expenditure: low-medium range of 30 to 80 dollars per pair, medium-high range of 80 to 150 dollars and high of 150 to 300 dollars per pair.

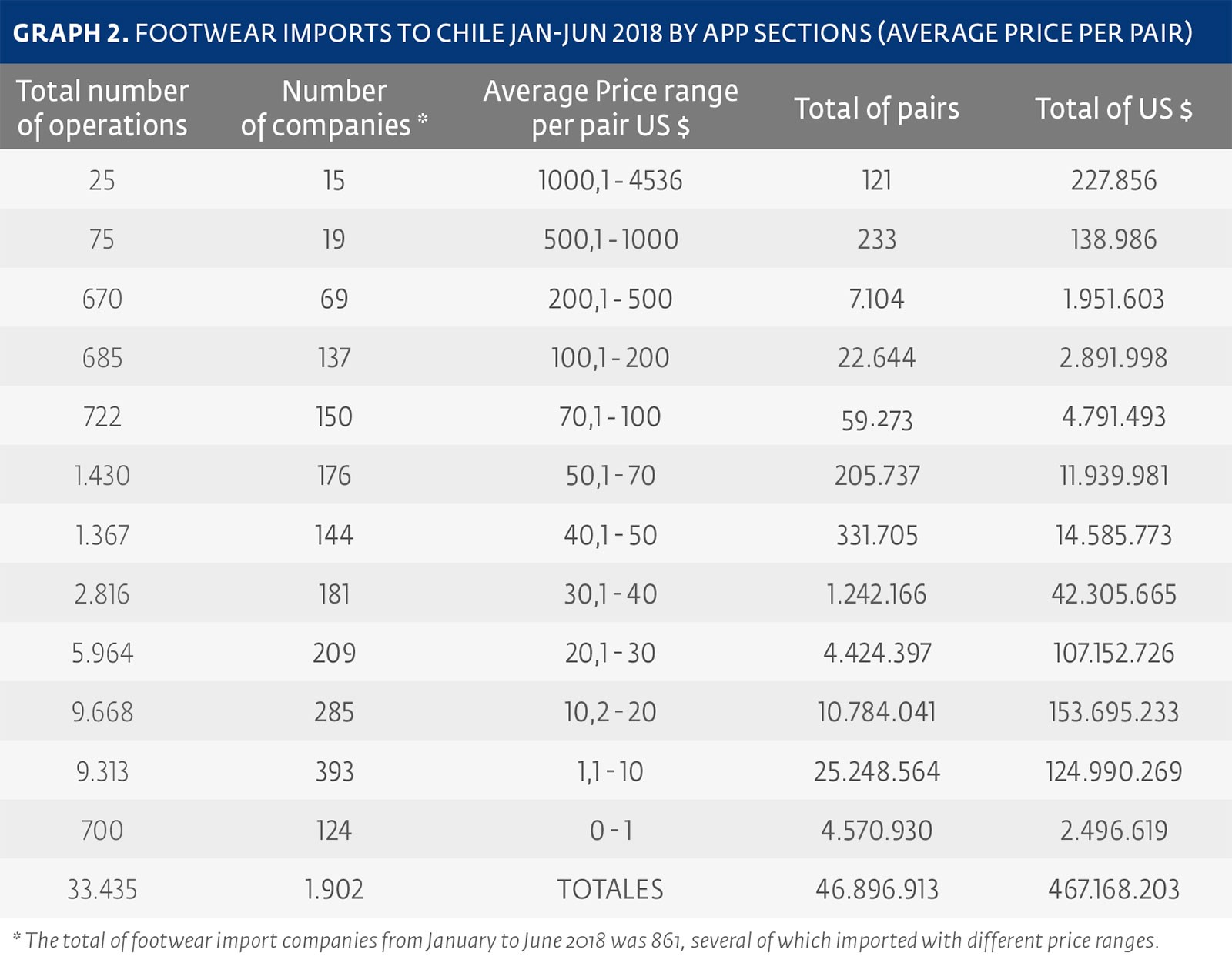

SEE GRAPH 2.

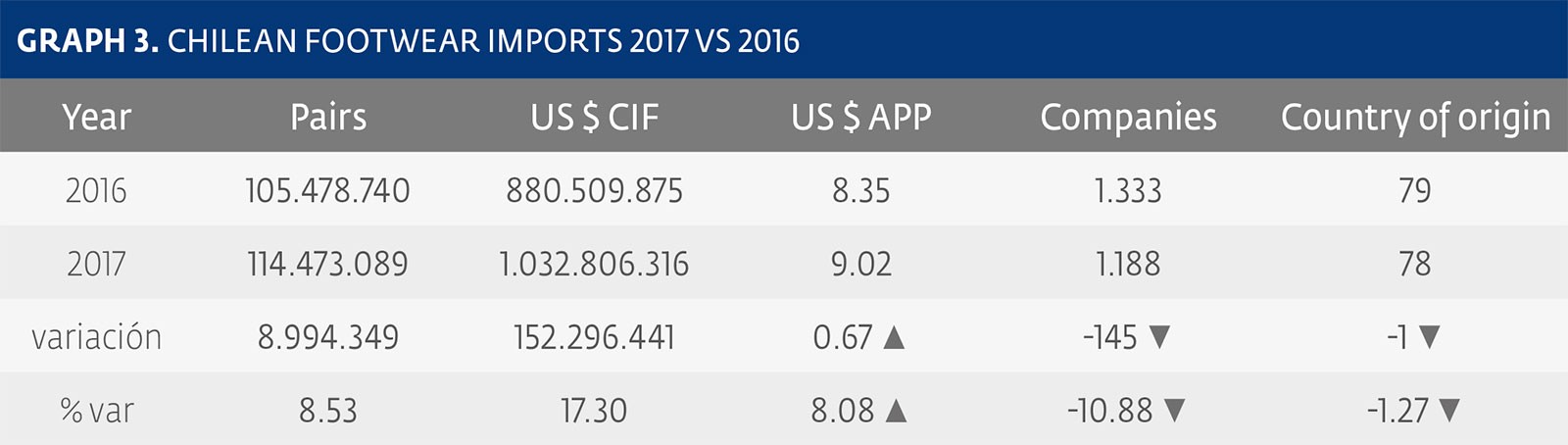

In 2017,

the footwear import figures registered in Chile constituted the historical

record throughout its history, with 114.4 million pairs imported for a total

value of over one billion dollars.

1,188

footwear importing companies from 78 countries were registered, at an average

price per pair (APP) of US $ 9.02.

If we

compare Chilean footwear imports figures of 2017 with those of 2016, we see an

increase in pairs and dollars of 8.53% and 17.3%, respectively.

SEE GRAPH 3.

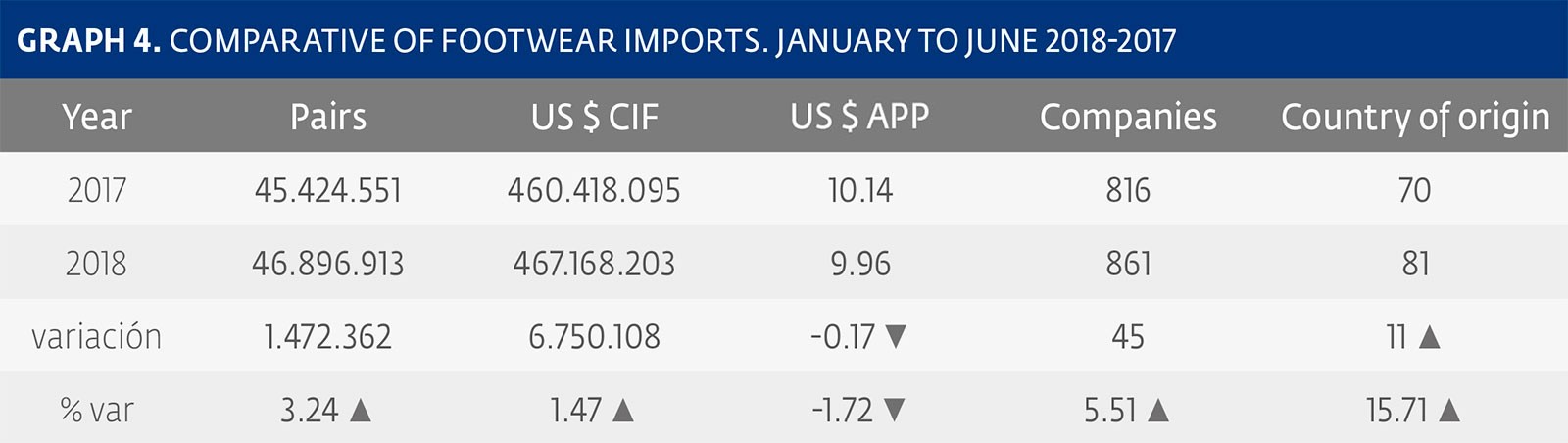

In the first half of 2018, there is an increase in

footwear imports of 3.24% in pairs and 1.47% in dollars, compared to the same

period of 2017. The average price per pair shows a slight drop of 5.51% (US $ 0.17 per pair), the number of importing companies

increases from 816 to 861, and that of the countries of origin increases from

70 to 81 countries.

SEE GRAPH 4.

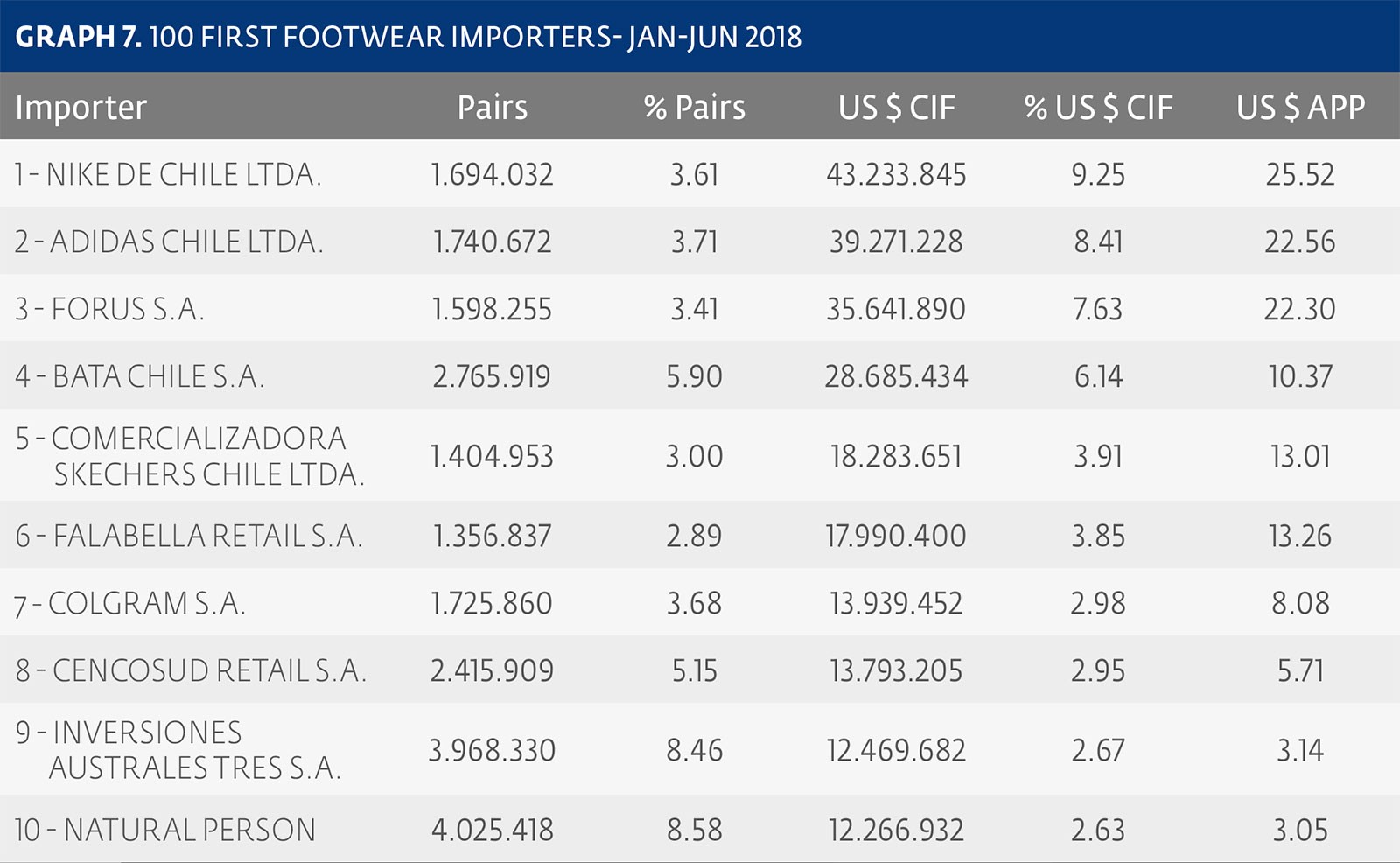

Paradoxically, going to the Transparency Law, the National Customs Office of Chile chose, as of July 2018, for not showing in its statistics all the names and RUT numbers of importers and exporters, discretionary faculty that was gradually applying for four years. For this reason the published figures of these operations appear under the name of NATURAL PERSON. These anonymous data in Customs Registries apply as of July 2018 in all foreign trade operations. This serious decision, which places Chile among the countries that hide customs information, with the discredit it entails, forced many unions, including FEDECCAL F.G., the Leather and Footwear Federation of Chile, to combat this measure until its extinction.

SEE GRAPH 5.

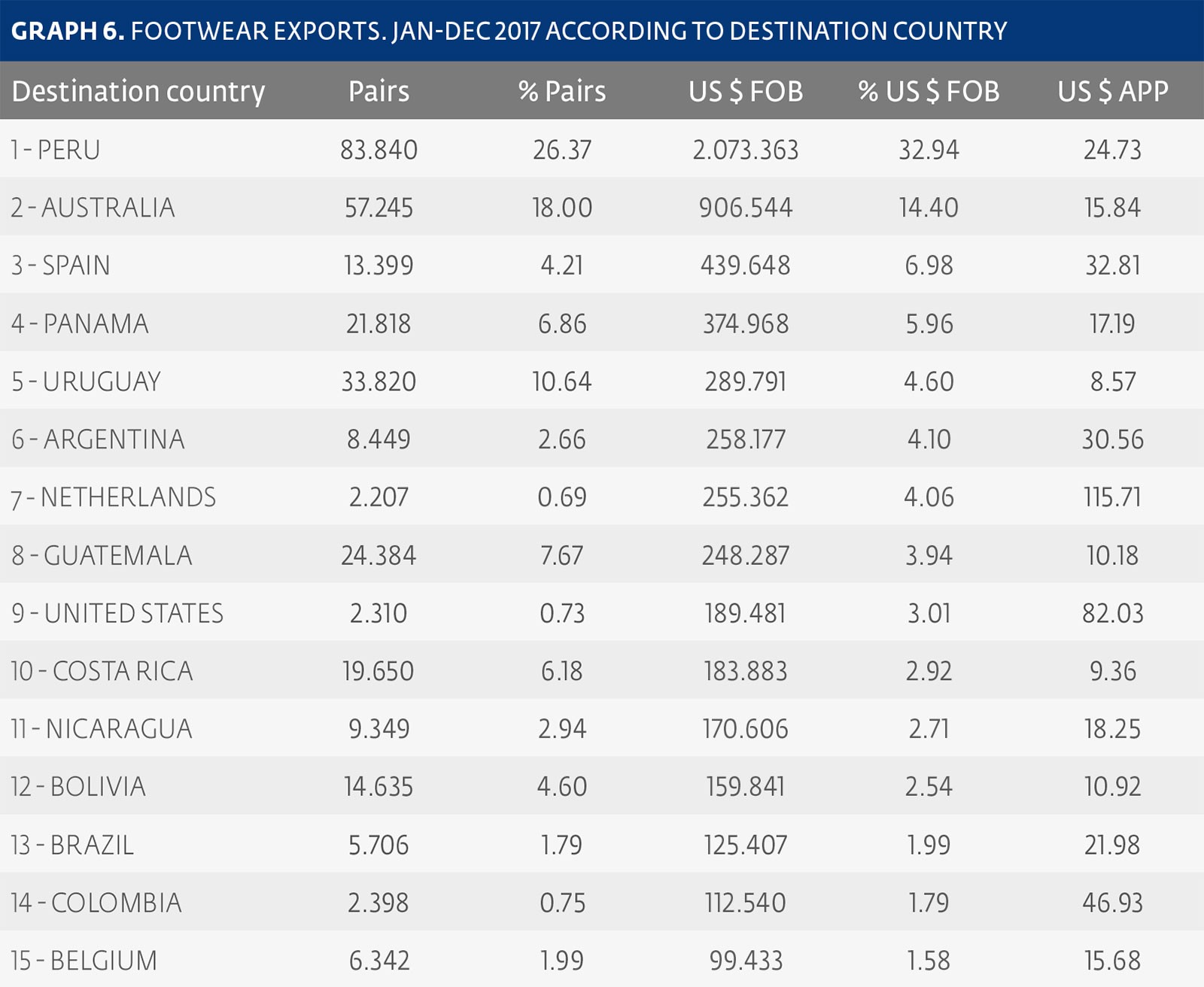

The export figures for Chilean footwear in 2017 show an increase of 2.96% and 6.13% of the pairs and dollars exported, respectively, compared to those of 2016. There were 16 companies that exported 317,981 pairs for a total value of US $ 6,295,162, to 26 countries of destination, with an average price of US $ 19.80 per pair.

SEE GRAPH 6.

Of the 26 countries of destination for total exports of footwear registered in 2017, Peru topped the list with 26.37% of total exported pairs and 32.94% of total exported dollars, followed by Australia, Spain, Panama and Uruguay. Argentina ranked sixth with 8,449 pairs for a total value of USD 258,177, exported at an average price of US $ 30.56 per pair.

SEE GRAPH 7.

Sources: Central Bank of Chile, National Customs Office, FEDECCAL F.G. -Leather and Footwear Federation of Chile and Pedro Beriestain, Director of the entity.