According to the WORLD FOOTWEAR YEARBOOK 2023, compiled by APICCAPS -the Portuguese Footwear, Components, Leather Goods Manufacturers' Association- with data from various international entities for 2022, global footwear production reached 23.9 billion pairs, recovering pre-pandemic levels. Production increased by 7.6% compared to the previous year. However, Africa experienced double-digit growth, while Europe and Oceania saw limited increases of 3.5% and 2.7%, respectively.

Despite varying growth rates, the geographical distribution of footwear production has remained relatively unchanged over the past decade when viewed on a continental level. Asia continues to be the largest producer, manufacturing over 87% of the world's shoes, the same percentage as in 2010. South America follows as the second most important region, but its share of global production decreased from 6% to 4.8%. Europe and North America have also experienced a decline in their respective shares. Africa is the only continent that has gained importance, although it represents less than 4% of global production.

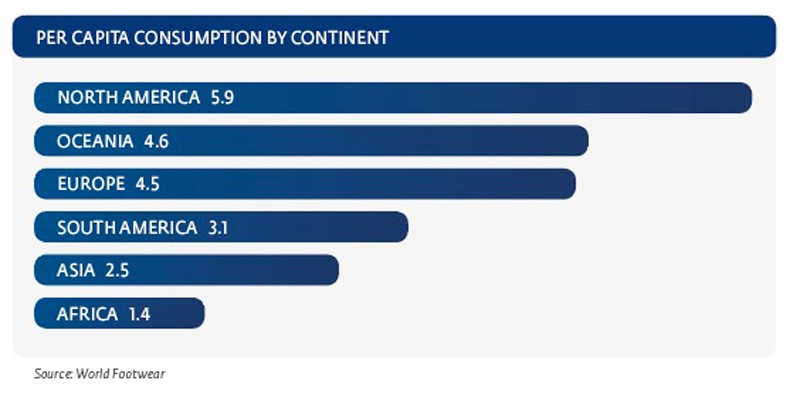

Footwear consumption, driven by population and income, is more evenly distributed than production. Asia, home to nearly 60% of the world's population, accounts for 53.2% of global footwear consumption, an increase of 49% according to the first edition of the World Footwear Yearbook in 2011. Africa's share of consumption has also been on the rise, currently at 9%, although considerably less than its share of the world's population (18%). However, in 2022, consumption growth was higher among the wealthier regions of the world. The consumption shares of North America and Europe (15.9% and 14.9%, respectively) have increased, clearly exceeding their comparative demographic data, due to their higher average income levels. The data reveals significant variations in per capita consumption worldwide, ranging from 1.4 pairs per person in Africa to 5.9 in North America.

China remains the largest consumer of footwear, although its share of the world total has decreased to 17.9%. Footwear consumption in the United States saw a notable increase of 12.7% last year, regaining the second position as a footwear consumer, surpassing India. Brazil and Indonesia have also changed positions, now ranking fourth and fifth, respectively. Further down the list, the Russian Federation and Bangladesh dropped off the list of the top 10 consumers this year, making way for the United Kingdom and France to secure the 9th and 10th positions. These 10 countries collectively represent 59% of global footwear consumption.

Footwear exports recorded a notable increase of 9% in 2022, reaching a total of 15.2 billion pairs. The proportion of exported production also increased, reaching its highest level in eight years at 62.8%. Although most of these exports originate from Asian countries, this percentage has decreased slightly over the last decade, from 85.3% to 83.9%. In contrast, the share of exports from European countries has increased from 11.4% to 13.2%. The contributions of other continents to global footwear exports remain relatively small, at 1% or less. Overall, the geographical pattern of footwear exports has remained virtually unchanged in recent years.

The list of the top 10 footwear exporters remains unchanged compared to 2022. These 10 countries collectively account for nearly 90% of footwear exports. China stands out as the source of over 60% of total exports. However, its share has decreased by more than 10 percentage points over the last decade. Vietnam has emerged as the main beneficiary of this reduction, significantly increasing its share from 2% to almost 10%. Turkey has also achieved notable performance and now ranks fourth among global exporters. Among European countries, Italy has dropped four positions and slightly reduced its share over the past 10 years, while Germany has nearly doubled its share and climbed two positions to secure the fifth place.

Last year, Asia recorded the largest increase (23.9%) in footwear imports, raising its share of the world total to 26.7%. Over the last decade, Asia's share grew more than 3 percentage points, surpassing North America to secure the second position in import volume. However, Europe remains the primary destination for footwear imports, accounting for over one-third of the world's total. Its share in 2022 remained unchanged compared to ten years ago. On the other hand, Africa and South America saw a decline in their share of imports last year. The United States is the destination for one in every five pairs of shoes traded internationally and witnessed a slight increase in its share of the world total last year. Germany had the highest increase (24.6%) among the top 10 footwear importers, expanding its share of the world total to 6%. This list is still dominated by European countries, with Japan and the United States being the only four representatives from other regions. The most significant change in this list compared to the previous year was the Russian Federation, which dropped from the 6th position to the 10th.

RELATED ARTICLE:

- Worrying decline in global footwear trade